Recommended Resources

We update this list of resources regularly trying to keep it up to date and relevant. Check back often for new additions and updates.

Last updated: December 5, 2025

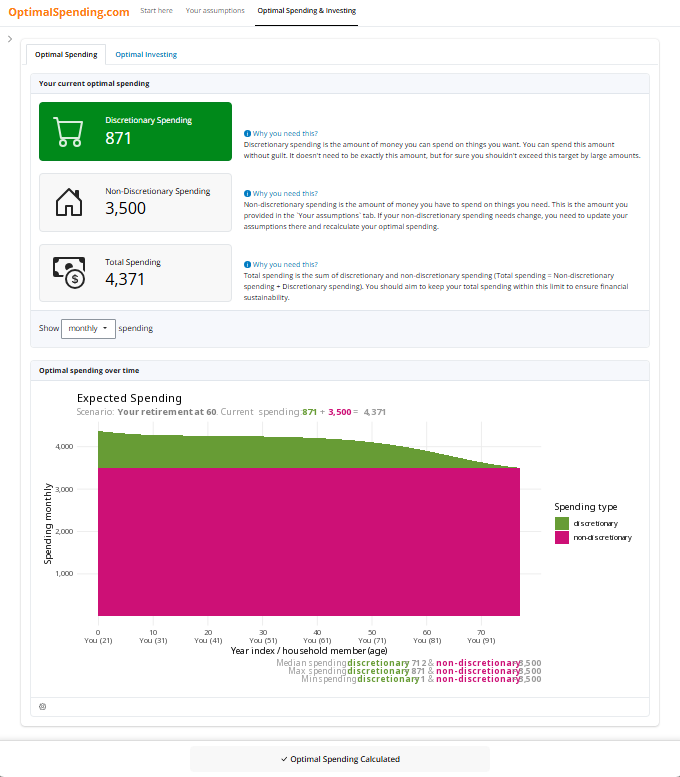

Interactive web application that allows you to explore different basic scenarios and see their impact on optimal spending and investing. The app respects your privacy - it runs locally in your browser and does not send your financial data to any server. The app is the companion to the Optimal Spending book and is free to use.

An open-source software library written in R statistical programming language. The package implements the life-cycle net-worth optimalization models. It is the engine behind the Optimal Spending Calculator App. The software is a bit more difficult to use for beginners but it allows much more flexibility and customization for advanced users comfortable with R.

- Package documentation: link

- GitHub repository with source code, issues, and development history for the package: link

- Package on offical CRAN repository: link

For Beginners

-

Are You a Stock or a Bond? Identify Your Own Human Capital for a Secure Financial Future

Moshe A. Milevsky (2013). FT Press. ISBN: 978-0133115291.

The book is easy to read and provides informative insights into personal finance. It clearly explains concepts like human capital, diversification, personal inflation, and risk of the sequence of returns, among other topics. A solid introduction for beginners.

-

Optimal Spending

Kamil Wais and Olesia Wais (in writing).

link

Our book - currently in writing. It will provide a comprehensive introduction to the concepts of optimal spending and investing using life-cycle net-worth optimization models.

For Intermediate Readers

-

The Missing Billionaires: A Guide to Better Financial Decisions

Victor Haghani and James White (2023).

link

The book that inspired the development of the R4GoodPersonalFinances R package offers a practical framework based on economic theories. It guides readers on how to allocate savings efficiently and optimize spending. The book includes a few simple mathematical formulas that are insightful and beneficial to grasp. It’s highly recommended for those with an intermediate understanding of the topic.

For Advanced Readers

-

Lifetime Financial Advice: A Personalized Optimal Multilevel Approach

Idzorek, T. M., & Kaplan, P. D. (2024). CFA Institute Research Foundation.

Book PDF available for download for free. There is also an excel file available with partial implementation of the models described in the book.

This book delves deeper than Missing Billionaires, unifying multiple economic concepts and mathematical formulas into a cohesive framework. New multilevel optimization model demonstrates how to make optimal decisions by considering various factors such as risk tolerance, human capital, non-discretionary spending, and asset allocation simultaneously. This comprehensive monograph covers many complex topics. Consequently, it is recommended for advanced readers with a strong interest in mathematical formulas and theoretical understanding.

link

-

Dynamic asset allocation: Modern portfolio theory updated for the smart investor

Picerno, J. (2010). Bloomberg Press.

Comprehensive review of modern portfolio theory, the role of diversification, rebalancing, and dynamic asset allocation.

-

Net Worth Optimization

Idzorek, T.M. and Kaplan, P.D. (2025). Financial Planning Review, 8: e1200.

link

-

A Hybrid Lifecycle Net Worth Optimization Model.

Kaplan, P. D., and T. M. Idzorek. (2025). Financial Planning Review 8, no. 4: e70018.

link

-

Solving the Net Worth Optimization Problem

Kaplan, P. D. (2025). Financial Planning Review 8, no. 4: e70019.

link

-

Popular Personal Financial Advice versus the Professors

Choi, James J. (2022). Journal of Economic Perspectives, 36(4), 167–92.

link

-

R for Good Academy (R4Good.Academy)

A series of blog posts showing how to use the R4GoodPersonalFinances R package to perform various personal finance calculations including optimal spending.

link

-

Essential Wisdom from Twenty Personal Investing Classics

By Jerry Bell, Victor Haghani and James White. October 29, 2025

link

Global Stock ETFs

-

Elm Capital Market Assumptions

Updated quarterly market assumptions for long-term expected return estimates for US and global equity markets.

link

-

The best World ETFs

Summary prepared by justETF.

link

-

(in Polish) ETF-y z ekspozycją na globalny koszyk akcji

Zestawienie przygotowane przez Atlas ETF.

link

Inflation-Adjusted Bonds

United States

-

Treasury Inflation‑Protected Securities (TIPS) real interest rates

link

-

I bonds interest rates

link

Poland

-

10-year individual bonds (EDO)

link

-

12-year limited personal bonds (ROD):

link